The question is answered by Lucas with a spread of 2 Tarot whose meaning is: Situation, Challenge.

The first card we have is the Knight of Cups. This card represents a period of great change in your financial life. You may be about to embark on a new business or investment that could bring wealth and abundance into your life. While this change may be difficult to make, it represents an important step towards realizing your financial goals.

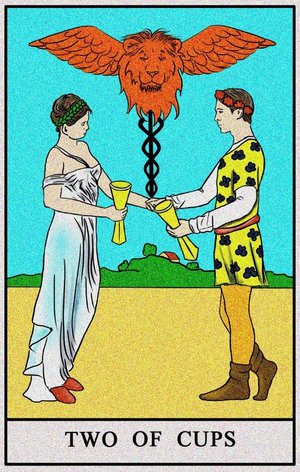

The other card is the reversed Two of Cups. This card indicates that you will face some challenges in your financial situation. There may be some difficulties in achieving your financial goals, but these are only temporary and could lead to a period of plenty if tackled with determination. Despite the hardships, there is still hope to achieve your financial goals.

In conclusion, the cards suggest that you are about to face a period of great changes in your financial life. While you will face some challenges, this period could bring great abundance if faced with determination. So my answer to your question is that your financial situation in the near future will be positive if you know how to face challenges with perseverance and self-confidence.

What are the odds of a big change in my long-term financial life?

Ultimately, these three cards suggest that you have the skills to make sound, practical decisions regarding a big change in your long-term financial life. However, your decisions need to be based on a careful examination of your situation and the underlying emotions fueling your concerns. It's important to consider all the factors involved before making a final decision because the results will have a long-term impact on your financial life. Hence, to achieve success in the financial field, it is important to take the time to analyze all aspects of the case and decide based on the information available.

Replay Video

What are the odds of a positive change in my financial life in the short term?

In conclusion, these three cards indicate that in order to have a positive change in your short-term financial life, you must first believe in yourself and your abilities, visualize a positive future and be proactive in acting on what you have decided. You will have to put in some effort, but you will see results in the end!

Replay Video

What can you tell me about my future financial situation?

In conclusion, the tarot suggests that your current financial situation is not the best, but there is still hope for improvement. You need to make responsible and thoughtful decisions with good money management. You should be flexible and willing to adapt to economic changes and be ready to seize any opportunities that present themselves in the future to improve your financial situation.

Replay Video

What do you recommend I do to save money each month?

In conclusion, the two papers suggest that the applicant should be more careful with their finances and try to save money every month. At the same time, he should be aware of the opponent's tendency not to make decisions based on prudent economic considerations. To achieve this, it is advisable to plan your expenses and look for creative ways to save money each month.

Replay Video

What do you recommend I do to save money when I shop at the supermarket?

Bottom line, if you want to save money when you shop at the supermarket you should consider looking into additional sources of income to improve your finances. You will also need to accept that there is a certain level of fixed cost involved when shopping at the supermarket. Finally, you should also shop around for any special offers or promotions that may boost your savings.

Replay Video

What do you think about real estate right now? Could this be a good time to invest?

In conclusion, the real estate sector offers great potential but one must be aware of the risks and challenges involved. Before making any decision regarding real estate investing, it is important to carefully evaluate all the factors involved and be prepared to face possible difficulties. Based on the Arcana examined, I think that at this moment the real estate sector presents good opportunities for investors who are more prepared and willing to make sacrifices.

Replay Video