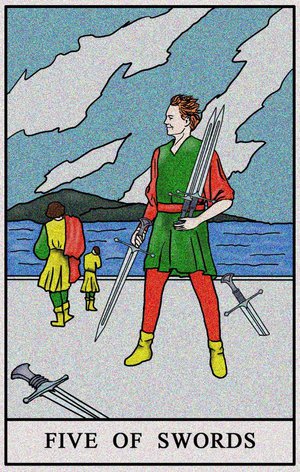

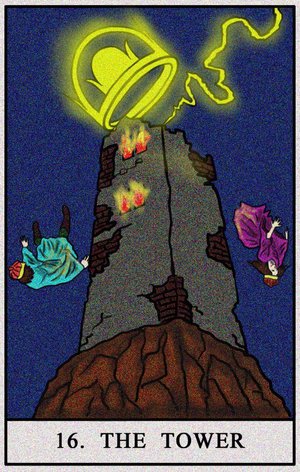

The question is answered by Lucas with a spread of 2 Tarot whose meaning is: Blockage, Solution.

The reversed Five of Swords is associated with a blockage or obstacle in finance, probably related to a wrong decision or a lack of information. The card also indicates that there is something blocking investment in bonds. It could be a bad financial situation, a lack of industry knowledge, a problem with the bank or something else. It is important to understand exactly what this block is before proceeding with the investment.

The Tower reversed is associated with the idea of looking for a solution to financial problems. This paper suggests that investing in bonds can be a way to solve the financial blockage or work around it. However, this card also indicates that the solution may not be easy to achieve. You need to do some research and consider all aspects before making a final investment decision.

The two cards indicated suggest that there is a block that prevents investment in bonds. To overcome it, it is important to understand what it is and then find a way around or overcome it. While it won't be easy, investing in bonds can be a way to solve your financial problems and improve your situation. Therefore, the most likely answer to your question is "Yes", bond investing can be seen as a useful way to solve financial problems.

What do you see for my future investments, especially those in real estate?

From the detailed interpretation of the two cards, we can conclude that your future investments in real estate can lead to financial success if you act with caution and make reasonable decisions. However, before embarking on any business in the real estate sector you should take more time to properly inform yourself on the subject and formulate a solid investment plan. Therefore, my answer to your question is "Yes but with caution".

Replay Video

According to your forecasts, will my sister Elisa be able to pay off her mortgage by the due date?

In conclusion, the forecasts of the two papers seem to say that Elisa will not be able to pay her mortgage by the due date. There are too many impediments to managing her finances efficiently and saving enough money to pay her mortgage. Therefore, the answer to the question is No.

Replay Video

What is the best way to invest in gold or other commodities?

In conclusion, these cards suggest that your financial situation is currently stable and that you do not need to rush into investment decisions. Before deciding how to invest your money, you should make sure you resolve any legal issues, carefully weigh all available options, and consider the risk and volatility associated with such investments.

Replay Video

What can you tell me about my financial situation, considering my mother Maria?

In conclusion, considering the tarot and the aspects under consideration, it seems that you should accept the economic help offered by Maria. Accepting help from others will help you build a safer and more balanced future, while refusing this support could lead to financial difficulties in the future. Therefore, my answer to the question is: Yes, Maria should accept the financial help Maria offers.

Replay Video

What are the best investment options to ensure my family's financial security?

In conclusion, your strengths are represented by the excellent ability to plan and organize your budget, as well as creativity and efficiency in the use of financial resources. Weaknesses are represented by a tendency to overestimate one's abilities and not to consider the negative effects of some financial decisions. The advice offered by the Bagatto (The Magician) is to be aware of the opportunities offered by the financial market, but also to be patient in choosing the right tools for your family. As for the most appropriate options for ensuring your family's financial security, you should take into consideration several factors such as the purpose of the investment, the associated risks, expert opinions and specialist recommendations.

Replay Video

I have received a proposal to buy land, but I need financing. Do the cards show the possibility of getting the loan?

The papers clearly show that you are ready to take on the responsibility of obtaining the necessary financing for the land purchase and are doing everything possible to secure it. Therefore, based on the cards chosen, the answer to your question is: Yes, you have a good chance of obtaining the requested loan.

Replay Video