The question is answered by Lucas with a spread of 3 Tarot whose meaning is: Strengths, Weaknesses, Advice.

Justice represents inner strength and perseverance that lead to success. In reading related to finance, it is possible to interpret this card as a strong sense of responsibility towards one's personal finances, as well as a good ability to plan one's financial future. This suggests that you have the resources to secure your financial future.

Four of Wands reversed indicates a block in realizing your financial goals. It could be due to a lack of self-esteem or a limited view of your finances. Also, it may indicate that you are facing some difficulties in getting what you want financially.

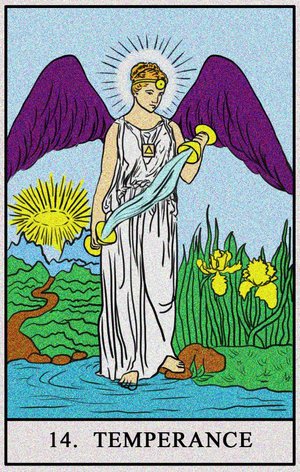

Temperance reversed represents the excessive attachment to material possessions and the impulse to accumulate them. This is a warning to avoid making imprudent investments because you may not be able to bear the consequences. Furthermore, it suggests that you may be too rigid in managing your finances and that it would be better to be more flexible and elastic in your financial decisions.

In conclusion, the three tarot cards suggest that although you have a company retirement plan, you will need to set realistic and achievable goals and be more flexible in your financial decisions to ensure a secure financial future. So, the answer to the question is: No, the company retirement plan alone isn't enough to secure your future.

I received an investment proposal from a friend, should I accept it or not?

From the papers it seems to suggest that the investment proposed by your friend could be a good way to build a better future. However, before making a final decision, you should carefully consider all aspects of your investment and any long-term implications. It is therefore advisable to do in-depth research, inform yourself and seek advice from people who are experts in financial matters or a financial advisor before proceeding with the investment. For this reason, my answer to the question is "No".

Replay Video

What are the prospects for a real estate investment in a certain area?

In conclusion, the financial situation relating to real estate investment is complex and potentially risky. However, if you take the right precautions and do your research, it can be a lucrative investment. So, if you wish to undertake an investment property in a particular area, it is vital to ensure that you have thoroughly assessed all the risks and opportunities before proceeding.

Replay Video

Should I invest my savings in a mutual fund or ETF?

In conclusion, the three interpreted cards suggest that, if you want to make an informed decision about how to invest your savings, you need to be aware of both ETFs and mutual funds. After weighing all the relevant aspects of investing, the most likely decision to make appears to be to invest in a mutual fund. This is because they offer more diversification and protection than ETFs, and it's easier to manage your investment risk with a professional dedicated fund management team.

Replay Video

What can you tell me about my brother Giuseppe's financial situation?

In conclusion, the reading of the cards suggests that Giuseppe is currently stuck in a vicious circle in financial terms. However, there are opportunities to consider getting out of it. The best solution is to reflect on his situation and develop an action plan to solve your financial problems. Answer: Joseph should work to find a solution to his financial problems, developing an action plan and asking for help if necessary.

Replay Video

I have financial problems which are affecting my family. What are the chances that things will improve?

In conclusion, considering the three selected tarots with respect to the theme "finance", it seems that you have confidence in your ability to manage your finances but at the same time there may be feelings of anxiety and frustration due to the impossibility of solving the problem on your own. Furthermore, it seems that you are not taking concrete steps to improve your financial situation. Because of this, the odds of things getting better are up to you. You must be willing to make the necessary efforts to solve your financial problems and take concrete steps to achieve financial stability.

Replay Video

What can you tell me about Marco's financial prosperity?

In conclusion, the tarot suggests that Marco possesses the skills necessary to achieve financial prosperity. However, he will have to be careful not to make mistakes and must be ready to deal with any sudden changes. Furthermore, he should make the most of all the economic opportunities that he may encounter along the way. Therefore, the answer to the question is: Yes

Replay Video